Option Hedging Strategy

FOR THE LIVE MARKET OPTION STRATEGIES CALL OR WHATSAPP ON 9039542248

Thursday, December 29, 2022

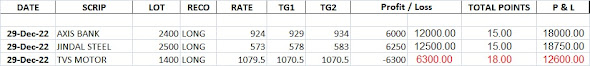

TODAY'S STOCK FUTURE CALLS PERFORMANCE 29 DEC 2022

Friday, October 28, 2022

CUMMINSIND STRATEGY ROCKSS RETURN OF 32400

CUMMINSIND STRATEGY GIVEN IN TODAY'S POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/10/cumminsind-plain-vanilla-strategy-for.html

CUMMINSIND 1300 CALL ROCKSS BOOKED PROFIT NEAR 54 BUY GIVEN @ 40

INVESTMENT 24000

PROFIT OF 8400

RETURN 32400

FOR MORE LIVE CALLS JOIN US ON WHATSAPP 9039542248

CUMMINSIND PLAIN VANILLA STRATEGY FOR NOVEMBER 2022

BUY 1 LOT CUMMINSIND 1340 CALL @ 34 TARGET 50

FOR THE LIVE CALLS JOIN US ON WHATSAPP 9039542248

CUMMINSIND PLAIN VANILLA STRATEGY FOR NOVEMBER 2022

BUY 1 LOT CUMMINSIND 1300 CALL @ 40-41 TARGET 53-54

FOR THE LIVE CALLS JOIN US ON WHATSAPP 9039542248

NMDC OPTION STRANGLE STRATEGY FOR 28 OCT 2022

BUY 1 LOT NMDC 110 CALL @ 2 AND 100 PUT @ 3.5

FOR THE TARGET UPDATES CONTACT ON WHATSAPP 9039542248

Wednesday, October 19, 2022

PROFIT OF 16200 IN INDUSINDBK STRATEGY

OPTION STRATEGY GIVEN IN 12 OCT 2022 POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/10/indusindbk-option-plain-vanilla.html

INDUSINDBK 1200 CALL BUY GIVEN @ 32 TARGET

49-50

PROFIT OF 16200

MOTHERSON OPTION PLAIN VANILLA STRATEGY FOR OCT 2022

BUY 1 LOT MOTHERSON 65 CALL @ 1.5-1.6

Wednesday, October 12, 2022

INDUSINDBK OPTION PLAIN VANILLA STRATEGY FOR OCT 2022

OPTION STRATEGY BUY 1 LOT INDUSINDBK 1200 CALL @ 32 TARGET 49-50

Tuesday, September 27, 2022

NET PROFIT OF 1200 IN IBULHSGFIN STRANGLE STRATEGY CALL

IBULHSGFIN STRATEGY GIVEN IN 26 AUG 2022 POST https://optionhedgingstrategy.blogspot.com/2022/08/ibulhsgfin-option-strangle-strategy-for.html

& BOOKED GIVEN IN 29 AUG POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/08/ibulhsgfin-strategy-book-profit.html

IBULHSGFIN 120 PUT BOOKED PROFIT NEAR 6 BUY GIVEN @ 2.5 PROFIT OF 14000

IBULHSGFIN 160 CALL LOSS OF 12800

Thursday, September 15, 2022

NTPC STRANGLE STRATEGY ROCKSSS PROFIT OF 21090

NTPC STRATEGY GIVEN IN 25 AUG POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/08/ntpc-option-strangle-strategy-for.html

NTPC 170 CALL ROCKS ACHIEVED TARGET 6.4-6.5 BUY GIVEN @ 2.6

PROFIT OF 21660

NOW NTPC 150 PUT CAN CONTINUE TO HOLD AS IT IS FREE OF RISK NOW

GET SUCH STRATEGY IN LIVE MARKET PAY JUST 5000 FOR 1 MONTH FOR MORE DETAILS WHATSAPP ON 9039542248

Tuesday, September 13, 2022

TATACHEM PLAIN VANILLA STRATEGY SEPTEMBER 2022

BUY 1 LOT TATACHEM 1240 CALL NEAR 23-24

FOR FREE STRATEGY TIPS JOIN US ON WHATSAPP 9039542248

GNFC PLAIN VANILLA STRATRGY RETURN OF 31200

GNFC STRATEGY GIVEN IN YESTREDAY'S

POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/09/gnfc-option-plain-vanilla-strategy.html

GNFC 800 CALL ROCKSSS ACHIEVED TARGET 23-24

BUY GIVEN @ 16

PROFIT OF 10400

INVESTMENT 20800

RETURN 31200

FOR SUCH ROCKING CALLS JOIN US ON WHATSAPP 9039542248

Monday, September 12, 2022

GNFC OPTION PLAIN VANILLA STRATEGY

OPTION STRATEGY BUY 1 LOT GNFC 800 CALL @ 16 TARGET 23-24

FOR FREE TRADING TIPS JOIN US ON WHATSAPP 9039542248

Saturday, September 10, 2022

Everything you need to know about bull markets and bear markets.

FOR THE LIVE TRADING TIPS IN OPTION CALL PUT/OPTION STRATEGY WHATSAPP ON 9039542248

Pigs are killed while bulls and bears profit from their slaughter. That is a proverb from the investing world, so why all the "animal talk"? How do bull and bear markets differ?Investors allude to the primary feature of financial markets and the beliefs that investors have about them using animal names. The two most well-known examples of this are probably bull and bear markets. Hawks versus doves is another illustration. What distinguishes a bull investor from a bear investor? Investors who have a bullish outlook on the market and anticipate price increases are referred to as "bulls." An investor who is pessimistic about the market's future direction and anticipates falling prices is referred to as a "bear." These expressions can also be used to describe the sentiment or attitude of the market. High levels of optimism and buying activity are indicative of a bullish market, whereas pessimism and selling activity predominate in a negative one.

Bear vs

bull market explained

Bulls and bears have been used in financial jargon since the 17th century. The term "bull" was first used to characterise the stock market on the London Stock Exchange (LSE) in 1769, according to bull vs bear market history. Eight years later, in 1787, also on the LSE, the word "bear" was first used.The way these creatures attack is said to be where the terms originated. A bear approaches from the side and swipes its claws down, whereas a bull assaults head-on by raising its horns into the air. These behaviours resemble how market values fluctuate. In a bull market, prices rise, and in a bear market, prices decline. Equity market benchmark indexes often spend more time rising than dropping, in terms of bulls vs. bearish equities. This is related to the psychological aspect of trading and loss aversion, where traders often panic and sell off rapidly following a market drop.Prices can also simply go sideways, which means they can repeatedly remain at the same level. Due to their higher volatility, other markets including foreign exchange and commodities futures frequently enter and exit bull and bear markets.

What is

a bull market? Key characteristics

Bull markets are typically linked to favourable economic conditions and a high level of investor confidence. A bull market has the following crucial traits: rising prices. This is evident in the market, where share prices and the value of other securities are rising. A bull market, according to some investors, is one that has increased by more than 20% from its 52-week low. This indicates an increase in investor confidence as the market is now 20% higher than it was a year ago at its lowest point. This indicates that more people are putting money into the market with the expectation of earning a profit. In general, the economy is doing well. With low unemployment and good growth, this indicates that the economy as a whole is functioning well. the bull market for the Dow Jones Industrial Average (DIJA), a benchmark US index, happens when the price is on an upward trend.

Friday, September 9, 2022

BSOFT 330 CALL ROCKSSS RETURN 20670

BSOFT STRATEGY GIVEN IN YESTERDAY'S POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/09/bsoft-option-plain-vanilla-strategy-for.html

BSOFT 330

CALL ROCKSSS ACHIEVED TARGET 15.8-15.9 BUY GIVEN @ 11.7-12

NET PROFIT OF 5460

INVESTMENT 15210

RETURN 20670

FOR THE FREE TRADING TIPS JOIN US ON WHATSAPP 9039542248

Thursday, September 8, 2022

BSOFT OPTION PLAIN VANILLA STRATEGY FOR SEP 2022

BUY 1 LOT BSOFT 330 CALL @ 11.7-12 TARGET 15.8-15.9

FOR INTRADAY OPTION TRADING TIPS JOIN US ON WHATSAPP 9039542248

Tuesday, September 6, 2022

DIXON OPTION PLAIN VANILLA STRATEGY FOR SEP 2022

BUY 1 LOT DIXON 4100 PUT @ 155

FOR FREE TRADING TIPS JOIN US ON WHATSAPP 9039542248

Friday, September 2, 2022

OBEROIRLTY PLAIN VANILLA STRATEGY ROCKSS

STRATEGY GIVEN IN YESTERDAY'S POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/09/oberoirlty-option-plain-strategy-for.html

OBEROIRLTY 1040

CALL ROCKSS HIT TARGET 50 BUY GIVEN @ 39-40

PROFIT OF 7700

INVESTMENT 27300

RETURN 35000

FOR THE LIVE CALLS JOIN US ON WHATSAPP 9039542248

Thursday, September 1, 2022

OBEROIRLTY OPTION PLAIN STRATEGY FOR SEP 2022

BUY 1 LOT OBEROIRLTY 1040 CALL @ 39-40 TARGET 50

FOR FREE TRADING TIPS JOIN US ON WHATSAPP 9039542248

ESCORTS PLAIN VANILLA STRATEGY ROCKSSS RETURN OF 26400

ESCORT STRATEGY GIVEN IN 30 AUG POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/08/escorts-option-strategy-for-sep-2022.html

ESCORTS 2100

CALL ROCKSSS ACHIEVED TARGET 47-48 BUY GIVEN @ 32-33

PROFIT OF 8800

INVESTMENT 17600

RETURN 26400

FOR LIVE CALLS JOIN US ON WHATSAPP 9039542248

-

FSL STRATEGY GIVEN IN 3 AUG 2022 TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/08/fsl-option-strangle-strategy-for-aug.ht...

-

STRATEGY GIVEN IN PREVIOUS 31 MAY 2022 POST TO CHECK VISIT https://optionhedgingstrategy.blogspot.com/2022/05/dixon-option-strategy.html ...

-

BUY 1 LOT CUMMINSIND 1340 CALL @ 34 TARGET 50 FOR THE LIVE CALLS JOIN US ON WHATSAPP 9039542248